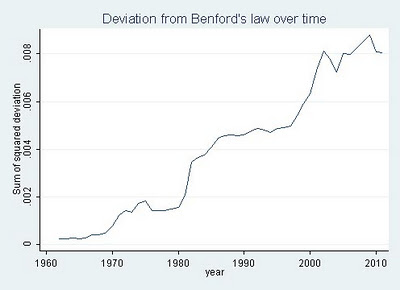

Economists have a rather simple statistical analysis that they use to measure the amount of falsification in financial statements. Essentially last digits in many types of data series follow a non-random distribution with one being the most common and 9 being the least. This structured variation in last digits is called Benford's law. Unsurprisingly (to statisticians and economists at least), over the past 50 years of increasing state intervention and regulation, public company financial statements have varied more and more from expected, indicating increasing levels of falsification. According to Benford's law, all of our regulation and extra auditing has made financial information less accurate - probably because all of the incredible complexity provides many more opportunities to hide, shade or 'interpret' information in ways that benefit the companies and perhaps the state sponsored actors that 'supervise' them. Below is the summary statistic. You can read more about it here. The funny thing is that none of this is new or particularly earth shattering. Just not reported.

So the question remains: how do you know what you know?

No comments:

Post a Comment