More children grow up without both of their biological parents in the US than in any other developed country. See here. Social decline and fragmentation is accelerating - a fact celebrated by the Democrats as 'guaranteeing' them a permanent majority. It seems the more isolated, frightened and morally depraved someone is, the more likely they are to vote for the partie de l'état.

Well Donks, I give you the joy of our decline.

Every time someone reads this blog an angel gets its wings. - Zuzu, the Elder

Friday, November 30, 2012

The final brick in the Social Democratic wall: US Birth Rate Plummets

Social democracy is a system of governance where those with political power systematically loot those without in the name of 'compassion' and 'social solidarity'. It is characterized by a generation or two of incredible comfort as massive, unsustainable debts are accumulated. It is also unsurprisingly characterized by a decline in faith in the future which is evidenced by falling investment and innovation and slowing economic growth. The final brick in the Social Democratic wall is the decline of humanity as people stop reproducing. Which is happening in the US as we speak.

All in all it is a wonderful approach to life. It's a pity the US has fully entered into it only in its decadent, collapse phase.

All in all it is a wonderful approach to life. It's a pity the US has fully entered into it only in its decadent, collapse phase.

Wednesday, November 28, 2012

Buffett: Tax Hikes On Rich Would "Raise Morale Of The Middle Class"

Every time I think that I've fully comprehended Warren Buffet's cynicism and PR manipulation he goes and proves me wrong. Schadenfreude is not an American family value. We do not feel better because we've succeeded in punishing someone else. Although maybe that's what happened in Buffet's family. That would explain his constant cynical manipulation. You can see the cynical old hoofer in action here.

But I'll take the Sage of Sanctimony's insight into envy as read: if the middle class would feel better by sticking it by a few points to the people who (temporarily) make more than them, how much more will they enjoy the confiscation of the entire 50+ billion fortune of one Warren Buffet?

And the cool thing is that then Mr. Buffet will be middle class so he can really enjoy watching other people get screwed.

Homespun Humbug indeed.

But I'll take the Sage of Sanctimony's insight into envy as read: if the middle class would feel better by sticking it by a few points to the people who (temporarily) make more than them, how much more will they enjoy the confiscation of the entire 50+ billion fortune of one Warren Buffet?

And the cool thing is that then Mr. Buffet will be middle class so he can really enjoy watching other people get screwed.

Homespun Humbug indeed.

The poor - not the rich - face the highest marginal tax rates

One reason welfare dependency has doubled. Welcome to the newest, bestest Social Democracy of them all: USA! USA!

Fragility, Antifragility and Us

Nissam Taleb has a new book out. Matt Ridley reviews it here. His thesis is that knowledge grows 'bottoms up' and that theory simply codifies the heuristics or rules of thumb that have been found to work over time - theory does not create reality. This means that complex systems that are designed centrally from the top down and managed by 'experts' (e.g. attempts to impose theoretical order on messy reality) are subject to catastrophic failure - he calls systems with these characteristics 'fragile'. According to Taleb the Fed is a classic fragile system. It is a complex, tops down institution led by 'experts' who have great confidence that they 'know' how to use the money supply and banking system to 'manage' the economy.

On the opposite end of the spectrum there are 'antifragile' systems - systems that actually get better the more failure and flux that they experience - Taleb cites both the restaurant industry and biology as systems that tolerate and indeed rely on many, many small failures to improve. Without the flux they stagnate. A free market economy is an antifragile system.

So what?

We are in the implementation phase of the two most complex and ambitious tops down system reengineering projects in the history of government. Anywhere. Ever. They seek in one fell swoop to transform the two largest, most complex sectors in America - Financial Services and Healthcare. Essentially they are attempts to centrally plan these sectors using tens or even hundreds of thousands of pages of regulations administered by thousands of 'experts'.

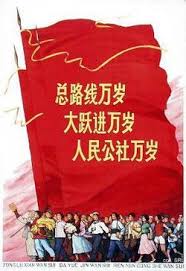

They are destined to fail, but as they fail I fear they will create enormous collateral damage in much the same way that the Fannie and Freddie bankruptcies were not just a couple failed specialty lenders but the trigger for a global financial collapse. Or in the way that Mao Ze Dong's

"Great Leap Forward" didn't just result in a lot of crappy backyard steel but in the starvation of tens of millions.

Of course tops down, expert driven theory is what you expect from our most 'academic' administration ever. The central conceit of the intellectual 'elect' that rule us is that by writing millions of runes on the magic Federal Register hard drive they can choreograph 315 million human beings spread over 3.6 million square miles and seven time zones like a Busby Berkeley dance extravaganza from the 1930s

On the opposite end of the spectrum there are 'antifragile' systems - systems that actually get better the more failure and flux that they experience - Taleb cites both the restaurant industry and biology as systems that tolerate and indeed rely on many, many small failures to improve. Without the flux they stagnate. A free market economy is an antifragile system.

So what?

We are in the implementation phase of the two most complex and ambitious tops down system reengineering projects in the history of government. Anywhere. Ever. They seek in one fell swoop to transform the two largest, most complex sectors in America - Financial Services and Healthcare. Essentially they are attempts to centrally plan these sectors using tens or even hundreds of thousands of pages of regulations administered by thousands of 'experts'.

They are destined to fail, but as they fail I fear they will create enormous collateral damage in much the same way that the Fannie and Freddie bankruptcies were not just a couple failed specialty lenders but the trigger for a global financial collapse. Or in the way that Mao Ze Dong's

"Great Leap Forward" didn't just result in a lot of crappy backyard steel but in the starvation of tens of millions.

Of course tops down, expert driven theory is what you expect from our most 'academic' administration ever. The central conceit of the intellectual 'elect' that rule us is that by writing millions of runes on the magic Federal Register hard drive they can choreograph 315 million human beings spread over 3.6 million square miles and seven time zones like a Busby Berkeley dance extravaganza from the 1930s

Paraphrasing Tiny Tim (Geithner): God help us every one.

Monday, November 26, 2012

Gondolas, it's all Gondolas these days

Reihan Salam points out a clever new idea: instead of stupid light rail, why not use overhead Gondolas - vastly cheaper and less disruptive. Cool.

The idea comes from Texas, in other words: from the future.

The idea comes from Texas, in other words: from the future.

Feds stomp Intrade

Intrade is a prediction market that is very useful for understanding consumer and political sentiment. It's more accurate than consumer surveys because people aren't stating their preference, their betting on being right. It's not a speculative risk or a source of criminal activity but the Feds are shutting it down for Americans anyway. So once again the world gets poorer and narrower due to our vile Federal Superstate.

Living the Hunger Games

Glenn Reynolds observes that America is increasingly tracking the script from the Hunger Games - a rich and flourishing capital feeding off the flesh of the 'provinces'. They're not states anymore, because states had autonomy and via the Senate, constitutional power. Today, the states are simply satrapies of an all powerful central government who buys their acquiescence with (for a little while longer) an infinite 'magic money machine'. Federalism is dead. Long live Panem D.C.!

Observations from the New York Times - even the trendy lefties are noticing:

As anyone who rides Amtrak between New York and Washington knows, the trip can be a dissonant experience. Inside the train, it’s all tidy and digital, everybody absorbed in laptops and iPhones, while outside the windows an entirely

Observations from the New York Times - even the trendy lefties are noticing:

As anyone who rides Amtrak between New York and Washington knows, the trip can be a dissonant experience. Inside the train, it’s all tidy and digital, everybody absorbed in laptops and iPhones, while outside the windows an entirely

Although mostly they avert their gaze until they alight in Washington to worship at the altar of power, money and glory.

The NYT Progs are finally noticing that Wall Street worships at this altar too:.

A few remarkable books by professors at N.Y.U.’s Stern School of Business argue that a primary source of profit for Wall Street over the past 15 to 20 years could be what I call the Acela Strategy: making money by exploiting regulation rather than by creating more effective ways to finance the rest of the economy.

In a world where politics picks winners and losers, those with political power win. Always. And the young and the poor? Well they're just props, you see - we'll bring 'em back out of storage at the next election.

Omaha's Homespun Humbug

Warren Buffet has penned a column in the NYT calling for his (now eponymous) Buffet tax on high earners. Mr. Buffet has always been a master at PR, but this is clearly his most brilliant work to date. Mr. Buffet argues that it is silly to believe that people's investment decisions will be changed by a change in the marginal tax rates. He cites his experience as a fund manager:

Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.

Of course while Mr. Buffet is talking about capital gains rates he is advocating higher marginal rates on income. Cleverly the Homespun Humbug claims that investors don't (or shouldn't) care about marginal tax rates on income and argues that they should be raised substantially on high earners because his fund is optimized to avoid taxes on income. Indeed, with a higher tax rate on income, Berkshire Hathaway will become a more attractive investment alternative for the very rich, making Mr. Buffet and his investors billions which will not be subject to the 'millionaires' tax that Mr. Buffet is proposing.

Between 1951 and 1954, when the capital gains rate was 25 percent and marginal rates on dividends reached 91 percent in extreme cases, I sold securities and did pretty well. In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent — and the tax rate on capital gains inched up to 27.5 percent. I was managing funds for investors then. Never did anyone mention taxes as a reason to forgo an investment opportunity that I offered.

Of course while Mr. Buffet is talking about capital gains rates he is advocating higher marginal rates on income. Cleverly the Homespun Humbug claims that investors don't (or shouldn't) care about marginal tax rates on income and argues that they should be raised substantially on high earners because his fund is optimized to avoid taxes on income. Indeed, with a higher tax rate on income, Berkshire Hathaway will become a more attractive investment alternative for the very rich, making Mr. Buffet and his investors billions which will not be subject to the 'millionaires' tax that Mr. Buffet is proposing.

But lets unpack his 'theory' of the market a little more: Essentially Mr. Buffet is implying that the after tax yield of an investment does not influence investors - they'll always make the investment. This is great news because it gives us an easy way to close the deficit - just eliminate the tax exemption on tax free bonds - their value won't change because Mr. Buffet says so - investors don't care! We could also clean up by eliminating the tax deduction for charitable giving, because if income tax rates don't matter for investing it would be crass to assume they mattered for charitable giving. And while we're at it, lets deep six the mortgage interest deduction because it clearly will have no impact on housing prices. Deficit problem solved. Ka-ching!

By making such a sophomoric and partisan argument, Mr. Buffet does a grave disservice to the debate - openly promoting junk economics in a cynical attempt to advantage his business. As a great Prog once said: "There comes a time when you've made enough money". But in our increasingly elitist, technocratic society the 'expert' who has the 'right' politics can get the most incoherent, self serving dreck published. Especially in the New York Times.

Perhaps we should establish a 'billionaires tax' that taxes fortunes of over $250 million (I can deflate as well as the next 'progressive') 1% of their market value each year - essentially a property tax for the very rich. This would have the advantage of attacking the real 'problem': disparities in wealth .

Do this and you will see what the ever so progressive Mr. Buffet and the rest of the very rich (who are heavy supporters of the President) really think about 'sharing the burden'. But you'd better buy earplugs because the screeches will be deafening.

Monday, November 19, 2012

After 450 AD the Goths and the Huns had an electoral lock on the Western Roman Empire too

Ross Douthat points out in the NYT the that the key to Democrat electoral success is social and economic decline. The more families dissolve, the more isolated minorities become, the more people become dependent on the dole, the more the Dems win. And IMHO, the more the Dems win, the more families dissolve, the more isolated minorities become and the more people who join the dole. I wouldn't quite call it a virtuous cycle - but it's certainly become a successful one.

Forward!

Forward!

Oxford English Dictionary: Omnishambles is newest word

Here. Which brings to mind another new, word: Obamashambles: meaning the state of a nation after it has been led by Barack Obama for four or more years.

Forward!

Forward!

Instead of Secession, why not try Federalism?

After all, it was the original design of our Union before the 'progressives' got a hold of it. Glen Reynolds makes the case for going back to the future.

Friday, November 16, 2012

Steyn: WH Press Corps "Court Eunichs'

Come to think of it, they do look a little limp. Here.

The Cruelest Chart

Not only are wages falling, the economy is not creating enough of these (substandard, low wage) jobs to soak up the increase in the labor force. The result is a massive and growing wast of lives. Sadly with the arrival of Obamacare, this trend is going to continue. When you implement a social democracy, you get social democracy rates of growth and employment. While many in the middle and upper middle class will feel more secure, it will be at the price of tens of millions of stunted lives spent in the economic shadows.

Oh well, BHO has power and that's the important thing. Isn't it?

Oh well, BHO has power and that's the important thing. Isn't it?

Tricky

Take a look at this chart:

Apparently, the high levels of hispanic immigration have driven down hispanic wages relative to the general population. Hispanics are becoming less economically assimilated over time. Of course each immigrant came to the US because their situation was improved by moving here so it's clearly not a personal tragedy for them. If it was, they wouldn't stay.

But it does raise a 'tricky' question. According to Ruy Texeria et al, the growth in hispanics is generating a permanent Democratic majority. Indeed the left promotes immigration at least partly for its electoral effects. Yet the stated reason the left wants to win these elections is to (correct me if I'm wrong) "increase social justice and reduce inequality". What happens when your tactic for winning power negates your reason for using said power?

Or take the young. Dems are very focused on (and successful at) recruiting young voters. Yet the power that they have won via these voters is used to protect and expand entitlement programs that take wealth from the young and give it to 50 and 60 somethings who by and large did not vote for Obama but just happen to have lots of political and economic power.

Again, when one's tactics to win power negate or are negated by one's policies what is left?

Only the power?

Hmmm: tricky.

Subscribe to:

Comments (Atom)